2024 Benefits

Medical Benefits

Eligibility

All employees who work a minimum of 20 hours per week are eligible for coverage on the 1st day of the month following 28 days of employment.

Summary of Benefits and Coverages

Brattleboro Memorial Hospital offers three medical plans for employees to choose from – Gold, Silver and Bronze. These plans offer varying deductibles, out of pocket maximums, coinsurance and copayments for services depending on which plan is selected and where employees choose to seek treatment.

Participants who choose to seek treatment for certain services at Brattleboro Memorial Hospital, Dartmouth Hitchcock Medical Center and/or Cheshire Medical Center will pay reduced copays and/or coinsurance for these services.

The links provided below outline each plan’s design and features.

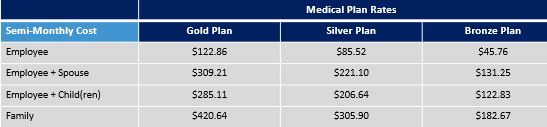

Contributions & Rates

Additional Information

Transparency in Coverage – Machine Readable Files

By clicking on this link (HPI – Machine Readable Files), you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Carrier Contact Information

Health Plans Inc: Medical Insurance

Customer Service: 888-335-9400

Website: http://hpitpa.com/your-resources/for-members/

Please click here for the HPI Provider Directory

Additional Medical Services

Telemedicine

BMH’s affiliation with Harvard Pilgrim/Doctor on Demand provides you the convenience of attending physician visits from your phone, tablet or computer. In addition to being fast and easy, you are only required to pay your physician office visit co-pay at HPI In-Network (Tier 3) benefit level.

Complementary Medicine

BMH also offers Complementary Medicine to employees enrolled in the Gold or Silver Plans. This benefit reimburses up to $250 to cover employees (and dependents) per calendar year. This benefit offers reimbursement for services such as: Biofeedback, Massage Therapy, Nutrition, Hypno-Therapy, Therapeutic Touch and Healing Touch, Preventative Physical Therapy, Homeopathy, Naturopathy, Oriental Medicine, yoga and Reiki.

BMH offers travel expense reimbursement to employees or dependents who need to travel out of state for medical services not rendered in the state in which they reside. The benefit is limited to $250 per calendar year and is included in the overall Complementary Medicine Benefit. The travel benefit is available to employees enrolled in any of the BMH medical plans. For more details, see the medical plan document or contact Human Resources.

Diabetes Management

Employees and their dependents enrolled in a BMH medical plan will have a $0 copay for any diabetic drug that is covered n the OptumRx formulary. This includes diabetic testing strips, lancets, insulin, metformin, and more. See the most current OptumRx Formulary List for details.

Prescription Drug Program

Prescription Drug Program

RxBenefits manages BMH’s prescription drug program. Prescription drug coverage is provided in 4 tiers – generic, preferred brand, non-preferred brand and specialty. For prescription drug coverage details, please review the pharmacy summaries attached below or contact RxBenefits Customer Service.

Specialty medications and mail order prescriptions are administered by Dartmouth Hitchcock Pharmacy. For more information please contact Dartmouth Hitchcock Specialty Pharmacy at 603-653-3785, or toll free at (855) 280-3893.

Member Materials

Carrier Contact Information

![]()

RxBenefits: Retail Pharmacy Program

Customer Service: 800-334-8134

Email: customercare@rxbenefits.com

![]()

Mail Order & Specialty Pharmacy

Phone: 603-653-3785 / (855) 280-3893 (Toll Free)

To initiate mail order or review Frequently Asked Questions click the link below:

https://www.dartmouth-hitchcock.org/patients-visitors/pharmacy#dhmc

Flexible Spending Accounts & Health Savings Accounts

Flexible Spending Accounts

Flexible Spending Accounts provide you with an important tax advantage that can help pay healthcare and dependent care expenses on a pre-tax basis. By anticipating health care & dependent care costs for the next year & setting aside money, employees can lower their taxable income. FSA and DCA accounts are administered by CSONE Benefit Solutions.

Flexible Spending Medical Account (FSA)

- Employees may contribute up to a maximum of $3,200 to the health FSA.

- The program allows employee’s to use the funds for certain IRS-approved expenses such as medical deductibles, copayments/coinsurance, and prescription copays.

- This plan includes a rollover provision that allows employees who elect the FSA to rollover up to $640 of unused funds into the next plan year for the medical FSA only.

Dependent Care Account (DCA)

- Employee may contribute up to a maximum of $5,000 (if single or married filing jointly) or $2,500 (if married filing separately).

- Pre-tax funds can be used to pay for qualified dependent care expenses such as day care for children under age 13 and/or elder care.

Health Savings Accounts

A HSA is a tax-advantaged account that allows employees to save pre-tax dollars to pay for qualified medical expenses. The entire HSA balance rolls over each year and remains yours even if you change health plans, retire or leave employment.

To be eligible to enroll in a HSA, you must meet the following requirements:

- You elect the Bronze High Deductible Health Plan

- You are not enrolled in Medicare

- You can’t be claimed as a dependent on someone else’s tax return

- You do not have other non-HSA compatible coverage such as a general purpose Flexible Spending Account (FSA), or Tri-Care

- You haven’t received Veterans Affair (VA) benefits within the past three months, except for preventive care. If you have a disability rating from the VA, this exclusion does not apply.

Health Savings Account (HSA)

- Employees are eligible to participate in a HSA if they are enrolled in the Bronze Plan.

- In 2024, BMH will contribute the following amounts to employee’s HSA (established with Health Equity):

- Single – $10 per pay period/$240 annual maximum.

- 2 Person/Family – $20 per pay period/$480 annual maximum.

- Contribution Limits:

- Single – $4,150

- Family – $8,300

- Catch-up contribution (age 55+) – $1,000

Forms and Plan Documents

Carrier Contact Information

CSONE BEnefit Solutions: Flexible Spending Accounts & Dependent Care Accounts

Customer Service: 888-227-9745 (option #1)

Website: www.csone.com

Health Equity: Health Savings Account

Customer Service: 866-346-5800

Website: https://healthequity.com

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Dental Benefits

Eligiblity

Employees who work a minimum of 20 hours per week are eligible for coverage on the 1st day of the month following 28 days of employment.

Summary of Benefits and Coverages

BMH offers dental plan options through Delta Dental. Benefit eligible employees can choose from three different dental plans.

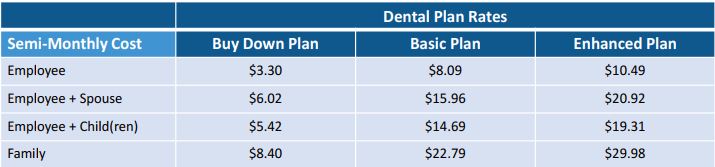

Employee Contributions

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: https://www.nedelta.com/Home

Please click here for the Northeast Delta Dental Provider Directory

Forms and Plan Documents

Additional Information

Vision Benefits

Eligiblity

Employees who work a minimum of 20 hours per week are eligible for coverage on the 1st day of the month following 28 days of employment.

Summary of Benefits and Coverages

BMH offers two vision plan options through VSP.

The benefit chart below is a summary of covered services.

Please note: VSP will not mail ID cards to members. A member ID card is not required for you to receive services or care – just tell your VSP network provider that you have VSP coverage.

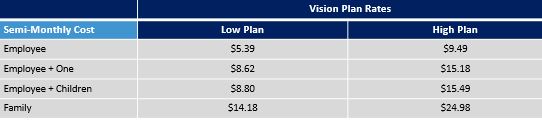

Employee Contributions

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: https://vsp.com

Click here for the VSP Provider Directory

Forms and Plan Documents

Group & Voluntary Life Benefits

Eligibility

Group Term Life and AD&D coverage begins on the first day of the month following 180 days of employment.

Supplemental Term Life and AD&D coverage begins on the first day of the month following 90 days of employment.

Weekly hours requirement for the benefits listed above:

Leadership, Physicians and Directors – 20 hours

All other employees – 30 hours

Summary of Benefits and Coverages

BMH provides benefit-eligible employees with the core benefits of life insurance and accidental death & dismemberment insurance. In addition to these core benefits, employees can also chose to purchase supplemental life and accidental death & dismemberment to cover themselves and their families.

Below is an outline of the coverages available under each plan.

Basic Term Life & AD&D Insurance:

- 100% funded by BMH

- Coverage amounts for full time and part time Leadership, Physicians and Directors is two times an employee’s annual base salary up to a maximum of $250,000

- Coverage amounts for all other employees working 30+ hours is 1.5 times an employee’s annual base salary up to a maximum of $250,000

- The same coverage amount applies to accidental death & dismemberment

- Please login to Bswift to update your beneficiary information as necessary

Supplemental Term Life & AD&D Insurance:

- 100% Employee funded

- Provides coverage that you can take with you (portable) if you terminate employment

- Employees may purchase from $10,000 up to 5 times their annual salary to a maximum of $500,000

- Employees may purchase coverage for their spouse in $5,000 increments to a maximum of 100% of the employee’s elected voluntary amount

- Employees may purchase from $2,000 to $10,000 on their dependent children (to age 19 or 26 if financially dependent)

- In order to purchase Life or AD&D coverage for your spouse and/or child, you must purchase Life or AD&D coverage for yourself

- Employees may select up to $250,000 in voluntary life coverage for themselves (or up to $30,000 for their spouse) within the first 30 days of employment without having to complete a medical questionnaire (evidence of insurability form). If applying outside of the first 30 days of employment, or for coverage in excess of the guaranteed issue amounts, a medical questionnaire will be required

- AD&D insurance never requires a medical questionnaire

Guaranteed Issue Amounts

Employee Supplemental Life – $250,000

Spouse Life – $30,000

Carrier Contact Information

![]()

Reliance Standard: Group and Supplemental Life & AD&D Insurance

Customer Service: 800-351-7500

Website: www.rsli.com

Contributions

Basic Life is 100% paid for by BMH.

Supplemental Life is 100% paid for by the employee. Premium costs are based on employee age at time of enrollment and amount chosen; Spouse rates are based on spouse’s age at time of enrollment and amount of coverage chosen. Rates for employee and spouse coverage increase as their age increases. Rates can be found on the bswift online benefits enrollment website.

Supplemental AD&D rates are based upon amount of coverage chosen and coverage on your child(ren) is based upon amount of insurance chosen.

Forms and Plan Documents

Additional Resources

Long-Term & Short-Term Disability

Eligibility

Long-Term Disability: Employees who work a minimum of 24 hours per week are eligible for coverage on the first day of the month following 90 days of employment.

Short-Term Disability: Employees who work a minimum of 20 hours per week are eligible for coverage on the first day of the month following 90 days of employment.

Summary of Benefits and Coverages

Long-Term Disability Insurance:

- 100% funded by BMH.

- Benefit is 60% of base monthly earnings up to a maximum of $10,000

- Payment of benefits begin after 90 days from the start of a qualified disability.

- Coverage continues while the employee remains disabled, until the employee reaches normal Social Security Age or as determined by the plan document.

Short-Term Disability (Voluntary) Insurance:

- 100% funded by the employee.

- STD insurance provides income protection when an illness or injury prevents you from working.

- Employees have two STD plan options with differing elimination periods (the length of time a member must be disabled before benefits are payable) to choose from.

- Both plan options pay a benefit of 60% of the employee’s weekly earnings to a maximum of $1,500.

- Rates vary based on the plan option/elimination period elected and the employee’s age.

- Pre-existing condition limitation: Benefits are not payable due to a pre-existing condition unless the total disability occurs after 12 months the effective date of coverage.

Carrier Contact Information

![]()

Reliance Standard: Long-Term & Short-Term Disability Insurance

Customer Service: 800-351-7500

Website: www.rsli.com

Contributions

Long Term Disability Insurance is 100% funded by BMH.

Short Term Disability Insurance is a voluntary benefit offered to the employees of BMH and is 100% employee funded. Employee premium rates are based on monthly income range, employment status (20-29 hours per week or 30 hours + per week), elimination period elected and employee’s issue age band. Benefit options and rates can be viewed during the bswift online enrollment process or in the bswift library.

Forms and Plan Documents

Accident, Critical Illness & Hospital Indemnity Insurance

Eligibility

All employees who work a minimum of 20 hours per week are eligible for coverage starting on the first day of the month following 90 days of employment.

Please Note: Accident, Critical Illness and Hospital Indemnity Plans do not replace your medical coverage; instead, they complement it.

Accident Insurance:

Accident Insurance is designed to help employees meet the out-of-pocket expenses and extra bills that can follow a covered accidental injury, whether minor or catastrophic. Lump sum benefits are paid directly to the covered employee if they sustain a covered injury. That benefit payment can be used however you’d like to spend it.

Examples of lump sum benefits payable include:

- $400 for ambulance (ground)

- $225 for emergency room treatment

- $75 for an x-ray

Coverage can be elected for an employee, spouse and/or child. Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis.

Critical Illness Insurance:

Critical Illness Insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness. Coverage is available for employees, spouses, and children. Coverage levels can be elected from $5,000 – $30,000 (in $5,000 increments) for employees and spouses. Coverage for a dependent spouse cannot exceed 100% of the employee amount elected. Coverage for children can be elected from $2,500 – $15,000 (in $2,500 increments) and cannot exceed 50% of the employee amount elected.

Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis. Rates are based on employee’s age at the date of issue. Spouse rates are based on the employee’s age at issue.

Hospital Indemnity Insurance:

With Hospital Indemnity Insurance, you will receive a fixed daily benefit if you have a covered stay in a hospital, that occurs on or after your coverage effective date. Benefits depend on the type of facility and number of days in confinement.

Here is how it works:

- When you are admitted to a covered medical facility, you become eligible for an admission benefit for the first day of confinement with a total benefit amount of $1,000. This benefit is payable once per confinement, up to a maximum of 8 admissions per calendar year.

- Beginning on day two of your confinement, for each day you have a stay in a covered facility, you will be eligible for a fixed daily benefit payment of $100. The benefit amount and maximum number of days per confinement varies by type of facility.

For more information, please review the benefit summaries below.

Additional Information

Carrier Contact Information

VOYA: Accident, Critical Illness & Hospital Indemnity Insurance

Customer Service: 877-236-7564

Website: https://claimscenter.voya.com/static/claimscenter

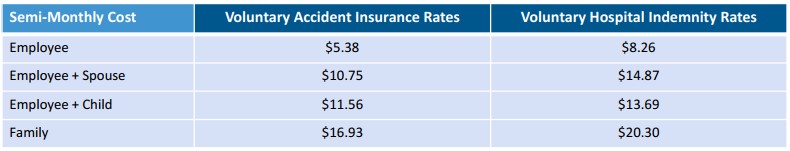

Contributions & Rates

100& Employee Paid

Accident & Hospital Indemnity Insurance:

Critical Illness Insurance:

Rates are based on age at the date of issue.

VOYA Wellness Benefit

Did you know? If you are enrolled in Accident and/or Critical Illness Insurance, you are eligible to receive a $50 wellness benefit to use however you want!

Complete an eligible health screening test and VOYA will send you $50!

- Employees receive an annual benefit of $50

- Spouses receive an annual benefit of $50

- Children receive 100% of your benefit amount per child, with an annual maximum waived for all children.

Please see the flyer below for details on how to file a Wellness Benefit claim

Employee Assistance Program

Eligibility

All employees are immediately eligible to participate in the Employee Assistance Program (EAP) offered by BMH.

Program Details

Brattleboro Memorial Hospital’s Employee Assistance Program, provided by KGA,

is a free and confidential benefit for all employees and their adult household members.

This program is designed to help you and your household members deal with a wide range of issues in your personal and work lives. Through KGA, you have free access to confidential counseling, expert consultations and referrals to resources including child care, elder care, legal, financial, nutrition, career, and daily living.

More information about the program and services can be found at www.my.kgalifeservices.com (Company Code: BMH) or by calling 800-648-9557 24 hours a day, 7 days a week.

Some examples of services are:

Counseling: Face-to-face, phone or video session to help resolve emotional issues

Legal Assistance: Legal consultation with an attorney and referrals for most legal issues

Financial Consultation: Help with debt management, budgeting and financial planning

Parenting Resources: Research and referral for all types of child care needs and parenting questions

Work-life Resources: Targeted research and referrals for everything from relocation services to college planning

Nutrition Counseling: Support from a nutritionist on weight management, allergies and other dietary concerns

Career Assessment: Interest testing and career exploration services

EAP Contact Information

KGA: Employee Assistance Program

Phone#: 800-648-9557

Website: my.kgalifeservices.com (Company Code: BMH)

Forms & Plan Documents

Wellness

Brattleboro Memorial Hospital is pleased to offer a number of wellness programs employees may choose to participate in to help with their overall health and wellness. For more information on the programs offered, please click on the button below:

For a full list of HPI’s wellness resources please click on the button below:

BMH Employee Health

Phone#: 802-257-8305

email: employeehealth@bmhvt.org

Retirement Plans

Eligibility

Employees are eligible immediately upon hire to make salary contributions on a pre-tax and/or after tax (ROTH) basis

403(b) Tax -Sheltered Annuity Plan

Plan Details

403(b) Tax-Sheltered Annuity Plan

- All employees are eligible immediately upon hire to make salary contributions on a pre-tax and/or after tax (ROTH) basis.

- Eligibility for the employer matching contribution and annual hospital non-elective contribution is 3 months of service with 250 hours worked.

- If an employee does not meet the initial eligibility, the employee becomes subject to a 1 year of service requirement (12 months of consecutive service with 1,000 hours)

- The annual hospital non-elective contribution will be 6% and will be contributed to 403(b) Tax-Sheltered Annuity Plan.

403(b) Matching Contribution is as follows

- 0-10 years = 100% of the first 1% of the employee’s eligible deferred compensation*

- 11 or more years = 100% of the first 2% of the employee’s eligible deferred compensation**

*Employees must have made 403(b) pre-tax or ROTH deferral contributions of at least 1% of their compensation

**Employees must have made 403(b) pre-tax or ROTH deferral contributions of at least 2% of their compensation

How to Enroll

*Retirement plan enrollments and changes are not made through the Bswift benefit enrollment system. Please follow the steps below to enroll in a 403(b) plan.

- Go to https://enroll.voya.com

- Enter plan number 664T21

- Enter Verification number 664T2199

Once enrolled, you can establish an online account by visiting: www.VoyaRetirementPlans.com

Have Questions?

TRG Retirement Plan Consultants are available

to help!

Email: HelpRetire@therichardsgrp.com

Steven Burnett | Allie Lambert |Tracey John

401(a) Money Purchase Pension Plan

- The 401(a) Money Purchase Pension Plan was frozen from further contributions in January 2023.

- This plan is not being terminated and existing funds will remain in the plan.

Retirement Plan Contacts

Voya: 403(b) Retirement Plan

Customer Service: 800-584-6001

Website: https;//enroll.voya.com (Plan # 664T21; Verification # 664T2199)

Plan Documents

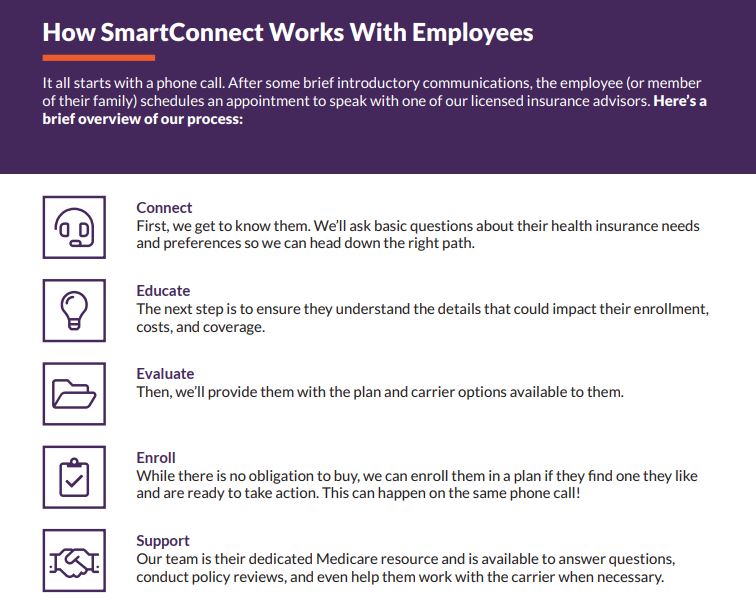

SmartConnect – Medicare Resource

Brattleboro Memorial Hospital has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, SmartConnect tailors solutions designed around your needs. Agents will provide an unfiltered view of the entire range of options and prices available.

For more information or to get started, please click in the following link https://gps.smartmatch.com/bmh

Additional Information & Resources

Video – Medicare 101

Tuition Reimbursement & Earned Time Benefits

Tuition Reimbursement

Brattleboro Memorial Hospital makes available $4,000 per calendar year for employees to pursue continued education through an accredited institution (tuition & fees only, excludes books & other expenses). This benefit is available to any employee scheduled to work *24 or more hours per week and who has been employed by BMH for a minimum of 1 year. The course must be related to the employee’s position or prepare him/her for a position of greater responsibility at the hospital. The application for tuition reimbursement should be completed and approved prior to taking the course. *As reflected in personnel file

Paid FMLA Parental Leave

After 1 year of continuous employment, and 1,250 hours worked, employees may be eligible to receive their FTE of 2 weeks of paid parental leave immediately following the birth or adoption of a child.

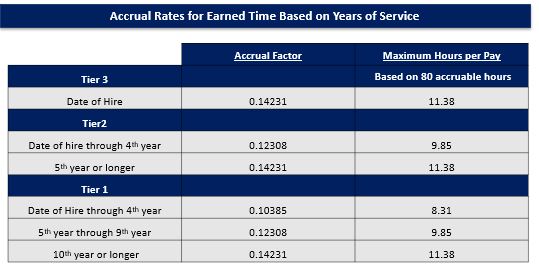

Earned Time

BMH provides employees time off with pay for vacation, holidays, personal days and sick days through the earned time benefit. The amount of earned time accrued is based on accruable hours worked. Employees must have 48 accruable hours or more per pay period to accrue earned time.

Earned time may be accrued to a maximum of 432 hours. Employees are encouraged to retain some of their accumulated earned time as protection against loss of income in emergency situations when days off with pay are needed and for regularly scheduled holidays.

Contact Information

Brattleboro Memorial Hospital Human Resources

For further information, please reach out to BMH Human Resources:

Phone: 1 (802) 257-3179

Email: hr@bmhvt.org

Did you know? We offer Student Loan Assistance through GradFin!

GradFin is designed to help BMH employees pay back student loan debt and improve their financial well-being.

Utilizing BMH’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN